No matter what your financial situation, it’s important to save for the future.

Especially when you’re young and still have decades of work ahead of yourself. But how much should you be saving?

And where should that money go? The answer is different for everyone, but in this post, we’ll explore some general guidelines for reaching your savings goals.

One of the most important financial decisions you will ever make is how to allocate your savings.

Because over time, the decisions you make regarding your savings rate and investment portfolio will have a huge impact on how long your money lasts.

So do yourself a favor, and think about how much to save now so that you can invest for retirement later.

If you don’t take the time to learn about these financial concepts, it will be difficult to make informed decisions and thus it will become more challenging to reach the level of financial success you desire.

It’s never too early to start saving.

So…

How Much Should You Be Saving?

Your savings rate will depend on your age, income, current expenses, and how soon you want to retire.

Many financial professionals suggest that you save between 10-15% income every month.

If you’re wondering how much you should save, take a look at your monthly expenses and figure out what percentage of your income is spent on each item.

For example, if you spend roughly $500/month on rent, your savings rate should be at least 10%.

But How Long Will It Take To Reach Your Savings Goals?

For example, if your goal is to have $1 million saved up by the time you retire at 65, you need to save around $750/month starting from age 25.

If you start saving earlier and put away more money each month, it will be easier to reach your financial goals.

And even if you don’t start early, you can still reach your goals with a steady savings rate.

But remember, the sooner you start saving, the more time your money has to grow.

For example:

Let’s say that you’ve started saving at age 25 and can save $750/month. And let’s also assume that you’re investing in a portfolio that will earn an average of 5% interest per year (which is roughly the historical return for the stock market).

If you save until age 65, that $750/month will grow into approximately $605,000.

That’s over $400,000 in just savings alone!

On the other hand, if you’re able to start saving at age 35 and save an extra $50/month, that $750/month will grow into approximately $500,000.

That’s over $300,000 in savings!

And if you start saving at age 45 and can save an extra $100/month (which would be difficult for most people), that $750/month will grow into approximately $246,000.

That’s still over $154,000 in just savings!

In addition to your age and monthly savings, the sooner you start saving, the more time your money has to grow.

So for example, if 35-year old starts saving at a 10% savings rate and manage to save an extra $100/month, they’ll have saved approximately $160,000 by the time they’re 65.

On the other hand, if that same 35-year old waits until age 55 to start saving (and still saves an extra $100/month), they would only end up with around $46,000 saved in the bank.

So don’t wait until it’s too late to save. Start young and set yourself up for financial success!

To figure out if you’re saving enough for retirement, consider the following:

Your current age, Your desired retirement age, How much you’ll need to spend per year in retirement (try using an online tool like this one ).

The average life expectancy of someone who is the same age as you (you can use an online life expectancy calculator ).

Divide how much you want to spend per year by your expected annual retirement income. This should give you a rough percentage of what your current savings will need to be in order to retire comfortably.

For example, if you’re 30 and plan on retiring at 67 (when you’ll likely live until 93), then you should have roughly 20 times your annual expenses saved by 67.

In order to calculate how much you should save each month, multiply the percentage from above by your monthly income, or take 15% of your gross income each month.

You may also want to include a buffer in case a financial emergency comes up and you need access to some of your savings.

Remember, there’s no one-size-fits-all approach here.

Be sure to take your age, income, expenses, and the expected retirement age into account when deciding how much to save for retirement.

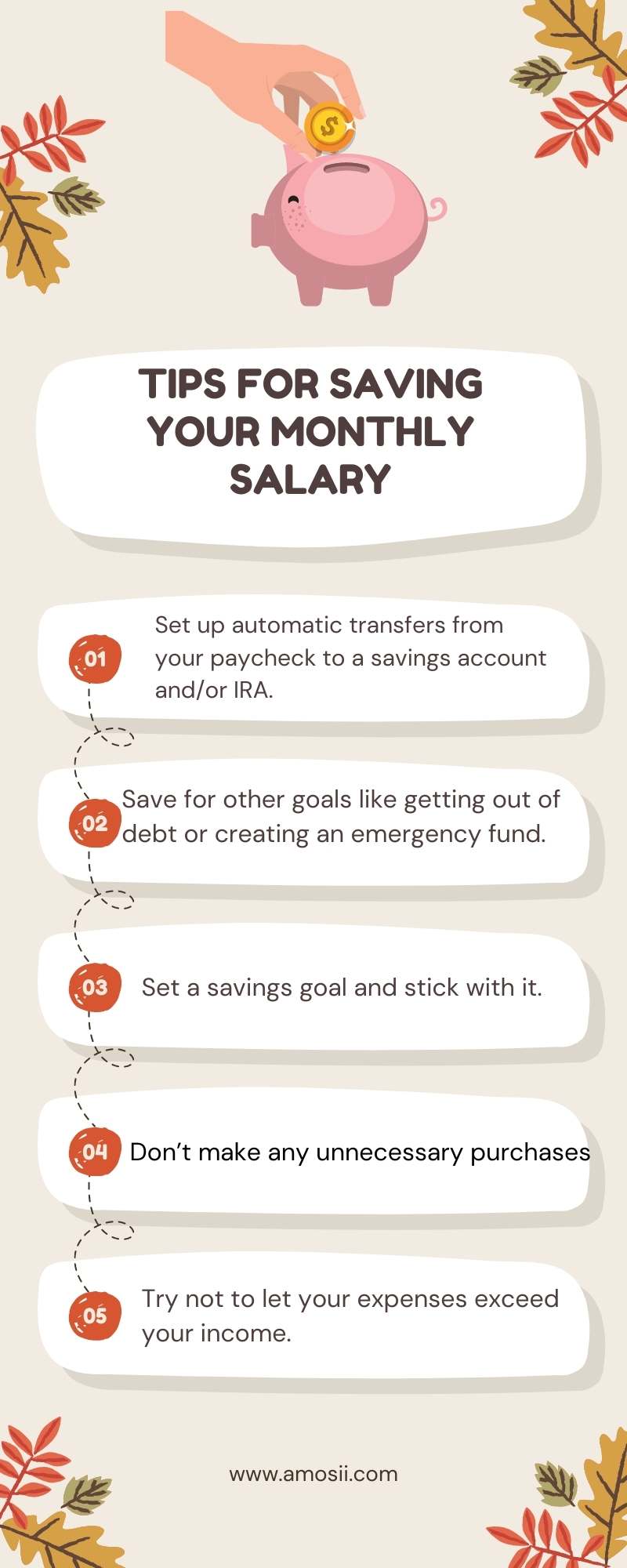

Tips for Saving Your Monthly Salary

If you’re having trouble saving enough for retirement, try these tips:

- Set up automatic transfers from your paycheck to a savings account and/or IRA.

- Save for other goals like getting out of debt or creating an emergency fund.

- Set a savings goal and stick with it.

- Don’t make any unnecessary purchases (this should help you cut down on impulse buys). Track your expenses (try using an app or spreadsheet).

- Try not to let your expenses exceed your income.

- Educate yourself on financial products and services.

- Figuring out how much you should save is a balancing act between your current expenses, your retirement goals, and the lifestyle you hope to have in retirement. While it may seem like a daunting number at first, finding a way to save the recommended 15-20% will ensure that you have enough saved for retirement. And if saving becomes easier, remember to periodically bump your savings rate up by 5%. This will help you gradually reach the goal and ensure that your savings last as long as possible.

Benefits of Saving Money

- One of the most obvious benefits of saving money is peace of mind. A recent study found that anxiety levels are lower for people with higher savings rates, and people who worry about money tend to be less happy on average.

- Saving money can also help you reach your life goals faster. Whether it’s going on a vacation or retiring early, having enough saved can make the difference between having to wait months or years to afford something you want. Savings can also help set up your family by getting you out of debt and building an emergency fund that could come in handy for unexpected costs like medical bills or car repairs.

- By taking control of your savings and staying on top of it, you can improve your credit score. Even if you already have credit cards or loans you’re paying off, increasing your savings rate can help you pay down debt faster and increase the amount of money available to borrow later on (assuming that borrowing will be necessary). This could help you get better interest rates, which in turn could save thousands of dollars over the life of a loan.

- It may seem counterintuitive, but saving money now can actually help you save money later. By living below your means, you are more likely to make good spending decisions over the long term because you don’t have to balance your wants and needs at the moment.

- Saving money can also be rewarding for your future self, as it makes you feel more in control of your life. And once you have some savings, you will feel that security right away since cash is less volatile than other investments like stocks, bonds, or real estate.

- Finally, saving money can have a positive effect on your relationships, both in the present and in the future when you are able to help out family members who may be struggling financially.

Frequently Asked Questions

Do I need to save the same amount for retirement every month?

Since your expenses, income, and expected age of retirement will fluctuate, it’s not always necessary to save the same percentage each month. Instead, try saving 15% of your gross annual income. This should give you a rough idea of how much you should put away.

What if I exceed my budget?

If you end up buying a home or having another life event that drastically changes your expenses, try saving a percentage of every dollar earned rather than a percentage of your total budget. You’ll still be able to save the recommended 15-20% by making small sacrifices here and there.

What if I can’t save that much?

You should still try to save as much as possible, even if it’s less than 15%. If you’re having trouble saving more, however, prioritize other goals like paying off student loans or creating an emergency fund.

When do I need to start saving for retirement?

It’s never too early or too late to begin saving for retirement. In fact, the sooner you save, the more time your money has to grow. If you’re in your 20s and have a long way until retirement age, try saving as much as you can.

If you’re in your 50s or 60s, consider downsizing to retire sooner.

How should I invest my retirement savings?

Retirement planning is made easier when you have other financial goals already set up, like debt reduction and an emergency fund. Once these are complete, try investing 15% of your overall portfolio in high-risk or high-return products like stocks, bonds, and real estate.